- Home

- Useful Information

- IBOR FAQs

FIMBANK IBOR FAQs

What does the phasing out of LIBOR entail?

What kind of impact are these changes expected to have on financial markets?

How is FIMBank responding to these new developments?

What deadlines are we talking about?

What scenarios is FIMBank contemplating for LIBOR contract conversions?

What are Risk Free Rates (‘RFR’) and how are they different from LIBOR?

Is the 31st December 2021 a global cut-off date for LIBOR?

What does the term ‘synthetic rate’ mean and how will these be applied?

What does the term ‘compounded in arrears’ mean?

How will spread adjustments work once LIBOR comes to an end?

How will spread adjustments be calculated?

How should I (or my firm) prepare myself for the end of LIBOR?

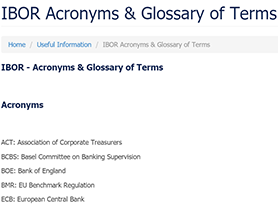

To view a list of Acronyms and a Glossary of Terms click the button below

FIMBANK IBOR FAQs

What does the phasing out of LIBOR entail?

On March 5, 2021, the United Kingdom Financial Conduct Authority (FCA) and ICE Benchmark Administration officially announced that the widely used benchmark interest rate, the London Interbank Offered Rate (LIBOR) will be phased out. The discontinuation of LIBORs has been earmarked for December 2021, with full completion targeted for June 2023. This announcement triggered the calculation of the fallback adjustment spreads, in order to ensure LIBOR transition economic neutrality and provide certainty to benchmark rate users once LIBOR no longer exists.

What kind of impact are these changes expected to have on financial markets?

This transition marks one of the most prominent changes with regards to the structure of financial markets globally, covering all financial institutions and their clients. It is intended that before 1 January 2022, new, risk-free interest rates based on real market transactions will have replaced the old reference interest rates. In the meantime, working groups across the globe have proposed alternative reference rates in each respective jurisdictions (see below).

How is FIMBank responding to these new developments?

In line with its commitment to satisfy the needs of its clients, FIMBank has set up an LIBOR Conversion team with the express objective of addressing any queries or issues clients may encounter in response to these developments. The Bank is therefore well prepared for the end of LIBOR and is ready to assist its clients with the transition process.

The team is also dedicated to ensuring that all exposures are appropriately and smoothly transitioned, and that fallback language is updated in anticipation of all deadlines, where necessary. Through its LIBOR Conversion team, FIMBank is also geared to assist its clients with the necessary funding facilities, in line with the recommended Risk Free Rates (RFRs).

From a commercial perspective, FIMBank will focus on developing and issuing new products and facilities based on alternative reference rates, while remediating existing LIBOR-based transactions.

What deadlines are we talking about?

- 30 September 2021

All new contracts have to have new RFR rates embedded

- 31 December 2021

LIBOR rates for all tenors of GBP, EUR, CHF and JPY as well one-week and 2M of USD will disappear. This means that all existing active contracts maturing beyond 2021 need to be converted to new rates before this date

- 30 June 2023

The remaining USD LIBOR rates will be discontinued; thus all USD LIBOR contracts will need to mature or to be converted into new rates by this date

What scenarios is FIMBank contemplating for LIBOR contract conversions?

The agreed and recommended conversion strategies are now embedded in the LIBOR contract conversion database for all FIMGroup transactions and includes 4 conversion scenarios:

- mature in 2021, for all contracts maturing in 2021,

- mature by 30 June 2023 - for all USD LIBOR, but other than O/N and two months, contracts

- convert to SOFR FLTR - by 30 June 2023 - for all USD LIBOR contracts (other than O/N and two months) maturing beyond 30 June 2023,

- convert to ESTR and SONIA FLTR - by 31 Dec 2021 - for EUR and GBP contracts maturing beyond 2021.

What are Risk Free Rates (‘RFR’) and how are they different from LIBOR?

Risk Free Rates (“RFRs”) are alternative reference rates that have been developed for use instead of LIBOR. Regulators for the five LIBOR currency jurisdictions have published their preferred alternative reference rates as shown in the table below .

|

Existing IBOR rate(s)

|

Successor

|

|

GBP LIBOR

|

SONIA

|

|

USD LIBOR

|

SOFR

|

|

EUR LIBOR, EURIBOR

|

ESTER

|

|

CHF LIBOR

|

SARON

|

|

JPY LIBOR, TIBOR

|

TONAR

|

Banks and other related institutions will be expected to adapt to the alternative reference rates set in the jurisdiction in which they operate.

While RFRs and LIBOR are both benchmarks, there are distinct differences between them, which include:

1. Reference Period: LIBOR is a forward-looking term rate, whereas RFRs are backward-looking overnight rates;

2. Methodology: LIBOR is derived from quotes provided by panel banks’ submissions that are meant to be estimates of where they could borrow funds, whereas RFRs are benchmarks generally based upon a broader range of actual transactions;

3. Credit Risk: LIBOR and RFR rates reflect different elements of credit risk. LIBOR is an unsecured borrowing rate and includes the implied credit risk of the panel banks and a liquidity premium related to the length of the interest period. RFRs do not include the panel bank credit risk element nor a liquidity premium related to the length of the interest period, as they are overnight rates. Some RFRs are unsecured and others are secured.

Is the 31st December 2021 a global cut-off date for LIBOR?

The notable exception is the US dollar LIBOR, where most LIBOR terms will continue to be published until the end of June 2023. Nevertheless, for all LIBORs, including the US dollar LIBOR, the message from the regulators to market participants is to stop using it as soon as possible, and no later than the end of 2021.

What does the term ‘synthetic rate’ mean and how will these be applied?

For most currencies, this will be a risk-free rate chosen by the applicable LIBOR currency area, adjusted for the relevant term of the contract, and with a fixed credit spread adjustment added. In other words, for example for the USD LIBOR market, “synthetic LIBOR” would likely be SOFR plus a modifier.

The goal of such a “synthetic LIBOR” would be to provide an additional tool that might facilitate the transition of certain so-called “tough legacy” LIBOR contracts.

What does the term ‘compounded in arrears’ mean?

Compounding in arrears is a methodology that compounds daily values of the overnight rate, throughout the relevant term period. Compounding in arrears differs from a typical term rate by calculating interest looking backwards and therefore such a methodology is usually accompanied by a brief period in advance of payment to set the interest rate and calculate payment. Compounding in arrears is compatible with a wide variety of derivatives and cash products. Please contact your FIMBank relationship manager for further information.

How will spread adjustments work once LIBOR comes to an end?

While LIBOR theoretically includes an element of bank credit risk, the replacement rates tend to be overnight risk free rates. Thus, their levels should be different. This difference should be solvable for new loans originated on the replacement rates, as new loans can have a higher margin to compensate for a lower base rate with different embedded optionality. However, it will matter for loans that “fall back” from LIBOR to any of the replacement rates upon LIBOR’s demise. Because these replacement rates are a different rate, there needs to be a “spread adjustment” that minimises the difference between LIBOR and these rates for these falling back loans.

How will spread adjustments be calculated?

The Alternative Reference Rates Committee (“ARRC”), the body tasked with LIBOR transition, has said that it will use “static” spread adjustments; in other words, this spread adjustment would be calculated once at LIBOR cessation. It would not be a dynamic spread adjustment meant to capture differences between LIBOR and replacement rates going forward. (The ARRC notes that potential dynamic spread adjustments suffer the same problems as LIBOR itself).

That settled, what would be the methodology for the static spread adjustment? To give an example, the ISDA (International Swaps and Derivatives Association) has decided to use the five-year historical median difference between LIBOR and SOFR (the US replacement rate) Compounded in Arrears. There would be different spread adjustment for different tenor pairs, e.g. three-month LIBOR to three-month SOFR, one-month LIBOR to one-month SOFR, and so on.

How should I (or my firm) prepare myself for the end of LIBOR?

It is recommended that you conduct an end-to-end inventory of LIBOR exposure. This should cover the full range of processes and systems, including for example (where relevant), pricing, valuation, risk management and booking. It should also cover contracts with clients, counterparties, creditors, employees, suppliers and others. These may include in-house or ancillary systems and where third-party vendors provide critical systems, you should get assurance on timely software upgrades in order to use alternative rates.

If you / your firm have LIBOR exposures or dependencies through either in-house or third-party investment managers, you should take reasonable steps to ensure they have plans in place to reduce these exposures or transfer to alternative reference rates in a timely manner. You should consider industry timeframes and the risks associated with LIBOR products. You should also ensure that the firms’ valuation systems are adapted to support the transition to alternative rates. In addition, you should ensure that any impacts on products are thoroughly assessed and any risks to policyholders appropriately mitigated.